Portugal Golden Visa program is a five-year residence-by-investment program for non-EU nationals. The Portugal Golden Visa allows free circulation in the Schengen area and only requires an average of seven days per year to stay in Portugal over this period, which can also count towards citizenship eligibility after six years.

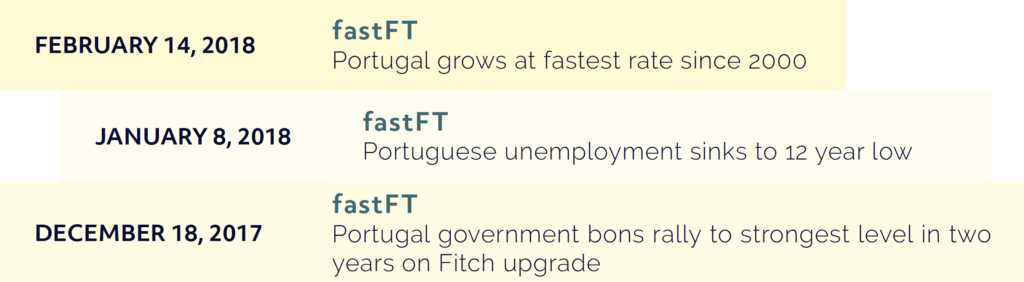

In addition to the booming economy, the country offers two very attractive initiatives created in order to attract professionals and high net worth individuals:

Non-habitual resident (NHR) status: a generous tax regime designed to encourage professionals of value-added occupations to set up residency in Portugal.

The Portuguese Golden Visa Programme: residency and subsequent citizenship for individuals and their families for investments in the property market ranging between €350K and €500K, depending on the age of the properties.

Evidence of such sentiment is already noticeable in the market. For example, last year Alphabet Inc’s Google announced its decision to open its new support centre for Europe, Middle East and Africa in Lisbon, and expects to create over 500 jobs in the region.

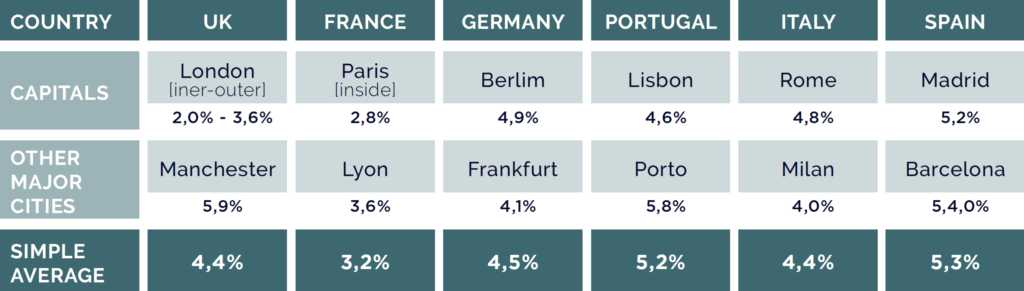

Buy-to-let in Portugal

Source: Deloitte’s Property Index Overview of European Residential Markets. Rental market – Is renting a dwelling a profitable investment? 6th edition, July 2017

In addition to the relatively high yields, an investor can also benefit from the low-risk profile of renting the property short-term via emerging channels such as bookings.com or Airbnb.

Portugal is strong in tourism and many agencies in the country have positioned themselves to offer comprehensive managed services to foreign investors who buy a second home for their summer holidays or indeed engage into buy-to-let deals with the option to use the property in the low season.

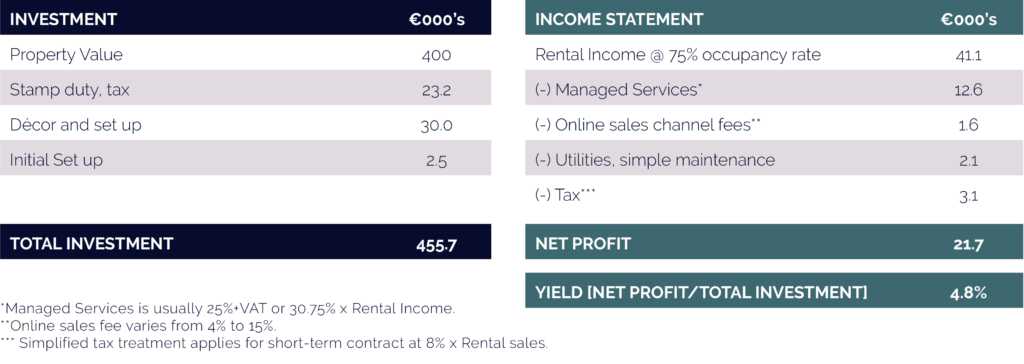

Short-term rental

A tested financial performance of short-term rentals in Lisbon and investors can enjoy an average of 5% yield, after tax and with the full support of an agency, including but not limited to managing check-in/check-out of tenants, cleaning and maintenance.

Example: 2-bed flat, inner Lisbon, medium-high décor, average day-rate of €150/day

Capital Gain

Non-habitual resident (NHR) status The NHR initiative has been attracting many foreign professionals, in particular from France, who choose Portugal not only to benefit from a more advantageous tax regime but also because its cosmopolitan capital, Lisbon, offers business opportunities alongside a high quality of life.

Golden Visa Programme

The Golden Visa Programme has been attracting investors from many nationalities including Brazilians, Chinese and Turkish who benefit two-fold when investing in Portugal: diversification of portfolio with high return properties and European residency within about six months, or citizenship after six years.

Affordable house prices

One of the key indicators when assessing whether property prices are likely to increase or decrease in the future is the Average House price/ Average Salary ratio. While house prices are trading at 10x salary in the UK and proving unaffordable for the local population, the multiple is just 5.5x in Portugal.

House prices in the UK, especially in London, have started to drop over the past year and most analysts predict further adverse adjustments for landlords when interest rates rise.

On the other hand, house prices in Portugal have been recording sustainable growth over recent years and this trend is likely to continue. If other high-tech companies follow Google’s decision to set up their offices in Portugal, average salaries are likely to increase and bring house prices in line. After all, Portugal seems very affordable compared to the rest of Europe.