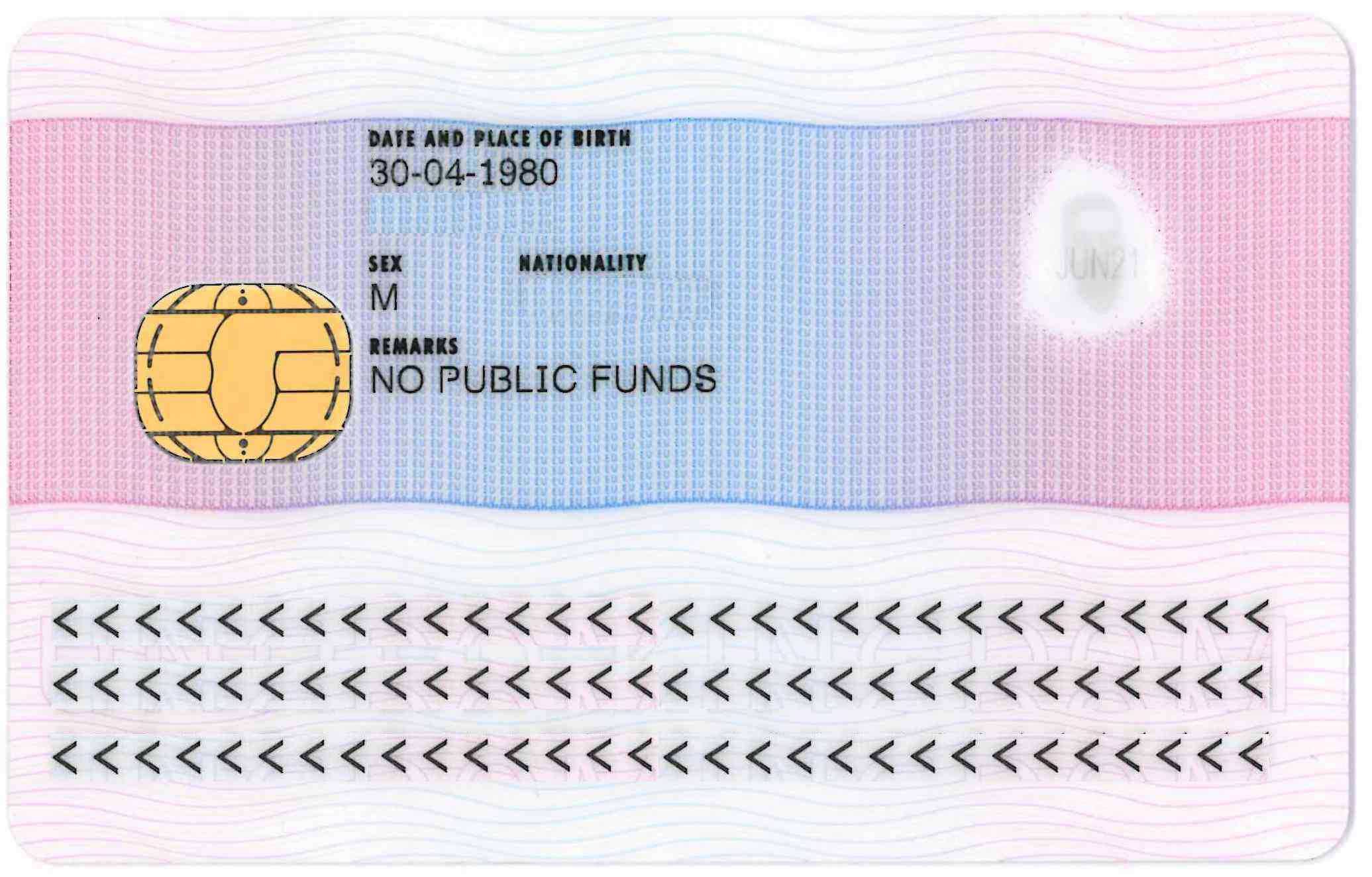

No recourse to public funds is a condition imposed on someone due to their immigration status. A person subject to immigration control may be allowed or prohibited from accessing specified public benefits and housing.

A person subject to immigration control” means a person who is not a national of an EEA State and who has;

| Type of Leave | Examples |

| Leave to enter or remain in the UK with the condition ‘no recourse to public funds’ | Spouse visa, student visa, limited leave granted under family or private life rules |

| Leave to enter or remain in the UK that is subject to a maintenance undertaking | Indefinite leave to remain as the adult dependent relative of a person with settled status (five-year prohibition on claiming public funds) |

| No leave to enter or remain when the person is required to have this | Visa overstayers, illegal entrants |

What are public funds?

‘Public funds‘ refers to most benefits, tax credits and housing assistance provided by the UK government. These include;

| Welfare benefits | ||

| Attendance allowance | Disability living allowance | Personal independence payment |

| Carer’s allowance | Domestic rate relief (Northern Ireland) | Severe disablement allowance |

| Child benefit | Housing benefit | Social fund payment – includes:

|

| Child tax credit | Income-based employment and support allowance | State pension credit |

| Council tax benefit | Income-based jobseeker’s allowance | Universal credit |

| Council tax reduction | Income support | Working tax credit |

| Housing | ||

| An allocation of local authority housing provided under the Housing Act 1996 (or equivalent legislation in Scotland and Northern Ireland) | An allocation of a housing association property provided via the local authority rehousing list | Local authority homelessness assistance provided under the Housing Act 1996 (or equivalent legislation in Scotland and Northern Ireland) |

Child benefit

When the parent of a British child has leave to remain with no recourse to public funds then they will normally be restricted from applying for child benefit or child tax credit if the other parent cannot apply for these unless one of the following exceptions applies:

- They are the family member of a British, EEA or Swiss national, for example, a parent of a British Citizen child. Note that this does not apply to Zambrano carers (primary carer of a British Citizen child) because they are excluded by the child benefit eligibility regulations.

- They are a national of Algeria, Morocco, San Marino, Tunisia and Turkey and are working lawfully in the UK.

- They are the national of, or a person who has come to live in the UK from, one of the following countries: Barbados, Bosnia-Herzegovina, Canada, Croatia, FYR Macedonia, Israel, Jersey & Guernsey, Mauritius, Montenegro, New Zealand, and Serbia.

- They were entitled to child benefit prior to October 1996.

Working tax credit

Nationals of Turkey and Croatia who are lawfully present in the UK can claim working tax credit even if they have no recourse condition.

Child tax credit

Nationals of Algeria, Morocco, San Marino, Tunisia and Turkey who are working lawfully in the UK can claim child tax credit even if they have no recourse to public funds.

People subject to a maintenance undertaking

When a person has indefinite leave to remain as the adult dependent relative of a person settled in the UK, they will have no recourse to public funds for the first five years that they are resident in the UK, or after the maintenance undertaking was provided (whichever date is later). Once this period has passed, they will be able to claim any of the public funds listed above that they are entitled to.

Can it effect your visa status?

Claiming a public fund when a person’s immigration conditions prohibit this could affect their current status and future immigration applications. If a person has claimed a public fund when they might not have been entitled to do so then they should seek legal advice from an immigration adviser and a benefits adviser.